Reading the mainstream business press, you might think that tech companies are going begging in their pursuit of investment capital. But when you work in martech, there’s another story.

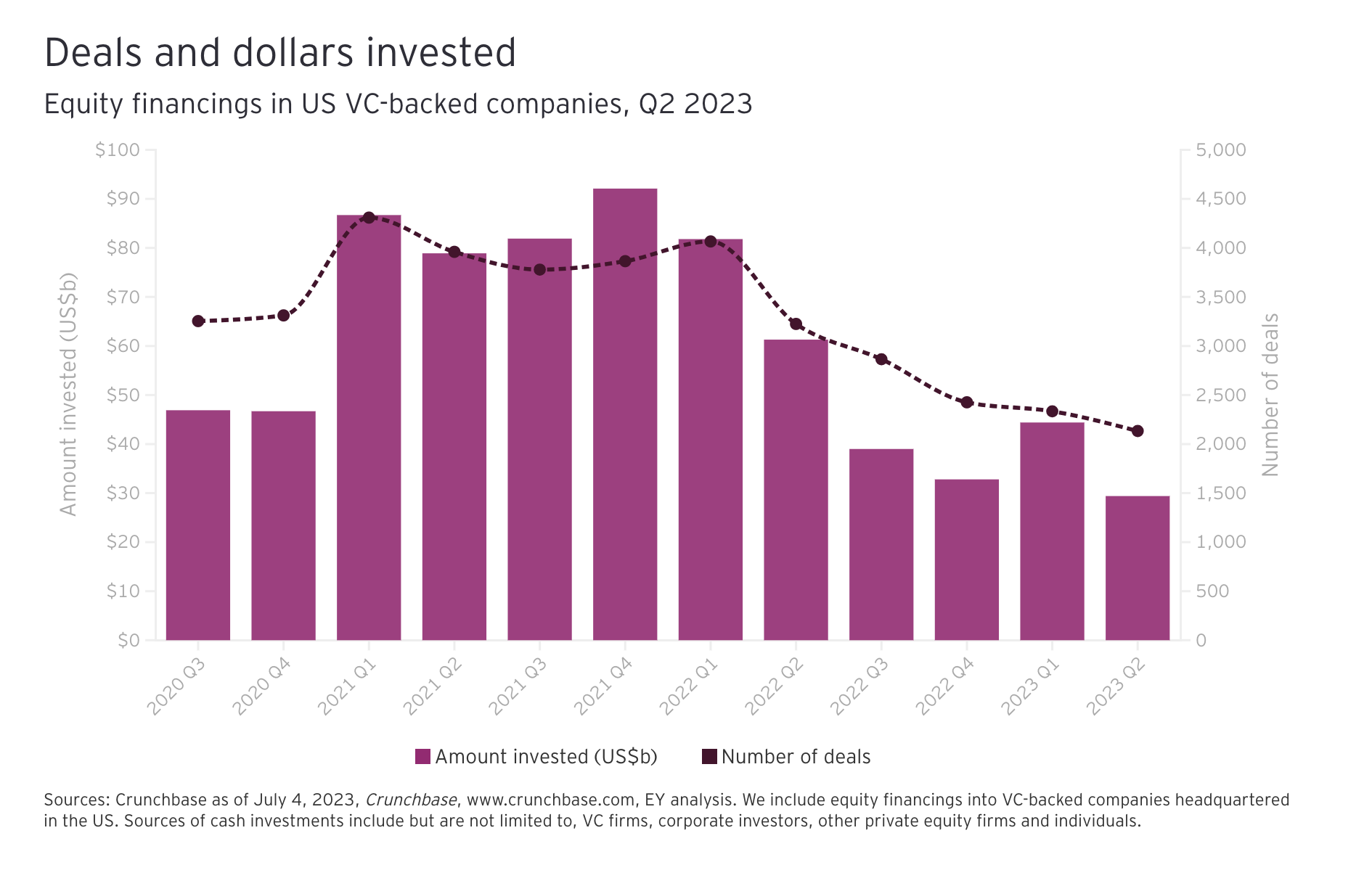

There has undoubtedly been a slowdown in startup investments over the past 18 months. The latest report from Ernst & Young, published in July, showed that VC activity was still trending significantly below 2022 (see chart below).

Promisingly for startups and scaleups, however, the drop has predominantly affected post Series-B businesses. The same report states…

“Early-stage activity has not been impacted as much as late-stage markets. Half of the VC deals in Q2 2023 were seed and Series A, raising $7.2 billion that represented a quarter of the VC investment.”

You can read the full EY report here.

Certainly amongst the VCs in my network, there is far less appetite for larger, cash-hungry businesses without the metrics to show near-term profitability. Instead, investors are looking to make smaller investments, far earlier in a business’s life cycle, in order to achieve strong ROI at lower risk.

And aside from investment capital, there remains client budget on the table – particularly around solutions with short time to value, that help businesses reduce the costs of existing processes, or which have a direct impact on marketing effectiveness and revenues.

The purpose of this special episode of Martalks is to assemble insights for martech leaders who are planning their pathway through the present economy, with some practical suggestions for how to secure their businesses’ ongoing success.

You can listen to the podcast in full here, or continue reading the article below.

We’ll look at:

- The types of companies most affected by the investment slowdown. While the investment ‘slowdown’ plays out amongst more mature scaleups in certain solution categories, early-stage firms, particularly those which propose to have a direct impact on companies’ profitability – are continuing to experience significant momentum.

- Then, we’ll look at some examples of businesses which have scaled successfully – including during previous downturns – and see what lessons can be applied to todays’ scaleups. Those lessons include pivoting/positioning your product and business model, to leaning off partnerships in order to affordably grow your marketing footprint.

- Finally, I’ll share some thoughts on the role of effective leadership in winning investment – and new business – that I’ve picked up through over two decades of collaborating with, and investing in, early-stage martech firms. There are certain leadership profiles that are always better set up for long-term success, but the current market will more quickly shake out those leaders who are cut from a different cloth.

The investment picture for martech startups

Towards the end of 2022, I spoke to Todd Michaud, CEO of the AI-powered automation vendor HuLoop, who succinctly explained the recent shift in technology buying trends.

“Most retailers don’t have the appetite for these massive enterprise systems right now. They’re anticipating cutbacks, economic headwinds…

“If we think about the pandemic era, everything was focused on digital transformation, ecommerce, enablement to serve customers in new ways, new channels.”

Businesses have always been wary of big-ticket projects. As Bloomreach’s Brian Walker explained on a Rosenstein Group webinar last year:

“In North America, you see a lot more mature businesses operating at scale, with experience of re-platforming projects that took a lot longer, cost a lot more than expected, and potentially didn’t deliver on the promises of the business case.

“These people could be on the third or fourth replatforming project of their career, and struggling to see how a further re-platforming is connected to their current business priorities.”

The difference today is that companies which might previously have been open to larger investments, in the US and beyond, are now showing a decreased appetite for the associated risks.

But that does not mean that martech has ground to a halt; far from it. The focus has shifted towards the adoption of composable third-party solutions that enhance companies’ wider architectures and extend the capability of existing systems.

At this year’s Shop Talk in Las Vegas, the mood among retailers was generally positive. They were actively engaging in discussion around their technology initiatives, and they were particularly interested in martech and composable commerce. Many were still planning on expanding their acquisition and deployment of commerce technology, understanding that there are a number of vendors in the space who can help them deliver improved customer experiences, whilst reducing the costs of some of their existing solutions and processes.

HuLoop is a great example. Todd describes his solution as a no-code, over the top AI automation platform, that in essence creates a digital worker that carries out processes in technical architectures for which businesses are currently relying on human labor, at a significant cost.

Other solution categories currently with good traction include CDP, PIM and analytics – tools which can be stood up relatively quickly, and quickly have an impact on the retailer’s bottom line.

Joshua Hudson, who heads up Pivotree’s master data management practice, told us on a previous episode of Martalks how increased capability around product information is increasingly recognised as a major commercial advantage.

“The early adopters to PIM were retailers. They were pulling in all this information from all the manufacturers and the manufacturers were historically terrible at managing their data, because they just wanted to sell the product and ship it out. Maybe they’d help out with stats, logistics, marketing (dimension data) but they weren’t especially helpful to the retailer.

“Then the distributors started to realise they needed to act how retailers did.

“And finally manufacturers now want to get that data in front of the client themselves. Seeing what the retailers were able to do with their “not so great” data enabled the manufacturer to see that if they owned that, they could cut out the middleman and reap the benefits…”

Josh went on to describe his favorite case study: a bicycle manufacturer going direct to consumer.

“This manufacturer’s data was scattered all over the place. It was a data management consulting piece.

“As soon as we went live… there were things the client did and didn’t know about how they were organised and the systems that were involved… the more we dug in and realised where we could streamline… we put some thought leadership behind it… once we had everything organised in the data supply chain, once they were confident they could share all the complexities around a product, they were able to strike up deals with retailers such as Competitive Cycles (large ecommerce marketplace) and then they launched their first every DTC model.

“It’s a large player in the space which has taken that data management shift and turned it into a whole new strategic business model.

“As soon as we went live – a month later they launched new strategic initiatives which were directly related to the work that we were doing.”

There are a few other verticals poised for growth. Best-in-class cybersecurity is becoming more sought-after, as retailers look to prevent shrinkage and losses due to fraud, while personalization vendors should also have opportunities to help retailers tailor their content and marketing on a more granular level to drive sales.

So – those are the solution categories where there’s currently the greatest momentum customer-side.

But how are fortunes differing for companies at different phases of growth?

We’re still seeing technology startups across sectors securing seed funding and Series A. These funding rounds typically total between $500,000 and $2m. Where we’re seeing less activity is in Series B and beyond for exploratory technologies.

This was neatly summed up by The Economist, in February 2023, in an article titled, “How the titans of tech investing are staying warm over the VC winter”.

It said that Silicon Valley is experiencing…

“a forgotten venture capitalism, with fewer deep-pocketed tourists splashing the cash and more bets on young companies by local stalwarts.

“In 2021… VC activity “was a bit unhinged”, says Roelof Botha of Sequoia Capital, “but rational”, given that low interest rates made money virtually free…

What passed for rationality in the boom times now looks a bit insane.”

With series B rounds often exceeding $30m, a ‘sane’ investment pitch now depends more heavily on having the right metrics – such as net promoter score, brand awareness, conversion rate and customer retention – which many companies simply are still building up during their first few years.

Adapting martech business models for scaling during downturns

If you’re an upcoming platform vendor, that may not fill you with confidence – but there are past examples of companies which have successfully scaled during previous downturns. These should give today’s martech leaders reasons to feel confident, as long as they pursue tried and tested strategies.

Of the major success stories, the one that stands out to me is Demandware. Originally founded in 2008, they were able to raise $9m in a Series C round in 2008, and then quickly followed that with a Series D round a year later, securing a further $12m of investment. That’s no mean feat, considering this took place in the midst of the Global Financial Crisis.

Demandware went on to grow exponentially before their IPO in 2014 and eventual purchase by Salesforce two years later, when the company was valued at $2.8b. How did they pull it off?

Demandware is an example of a business that was laser-focused on adding value to its customers at every touchpoint, not only in its value prop, but in its marketing and product development. They nurtured a community of users, actively engaged them and learned from them, and shared those lessons, building a library of first-class sales enablement tools.

These are tactics which have featured repeatedly on Martalks as we’ve uncovered the commercial strategies of today’s martech leaders.

Rajib Das, the chief executive of digital agency Ignitiv, name checked two vendors for their willingness to ease implementation with clients. One of those vendors, Klaviyo, was acquired by Shopify for $100m in the summer of 2022.

Rajib praised their partner content on an episode of Martalks recorded at the end of 2022:

“Klaviyo has led with so much content that you could learn everything you need, provided you understand email marketing, … and your own team could be carrying out implementations right from day one… I was very impressed by Klaviyo’s partner content strategy. It allows you to build up skills in an easy manner.”

When talking about the relationship between Ignitiv and the commerce platform Kibo, Rajib said the two parties are “joined at the hip” during the implementation process for their clients.

There’s also scope for businesses to partner around product innovation. Chris Lemmer, the co-founder of digital agency SwiftCom, built a free integration between WooCommerce and Vue Storefront.

The WordPress-enabled solution remains the most common ecommerce platform in Chris’ home market of South Africa, as well as being widely used in many other markets.

Chris identified an issue developers were having in scaling with WooCommerce, through a simple and cost-effective piece of market research:

“What’s the smallest experiment you can do to test and see whether people will actually use this product? That’s the approach we want to take.

“So the approach we took, as a small startup agency without hundreds of thousands of dollars, is we created a landing page for our Vue Storefront-WooCommerce integration…

“We ran some Reddit ads, we spent $250, to be exact. And we got about 20 or 30 email addresses of people subscribing for beta programmes… and we’ve interviewed probably about ten, asking about the challenges and validating this problem.

“And it’s clear across the board, across the globe… We’ve interviewed people from the states from the UK, from Mauritius, from South Africa. And the problem people are facing is the same.”

For the cost of just $250, Chris has positioned SwiftCom as a trusted partner not only to clients, but also to Vue Commerce – who, in turn, quickly gained access to a far larger share of an untapped market segment in Africa, and worldwide.

Partnerships between vendors can be similarly productive. Todd Michaud told us how HuLoop operates an OEM model, allowing their product to be white-labelled by other retail software providers – another, affordable route to market, that leans off the business development budget of the partnered company, and its incumbent customer relationships.

The recurring theme here is the importance of partnerships to technology vendors, particularly in an ecosystem where interoperability is part and parcel of the modern martech value proposition.

Jay McBain of Canalys explains that for API-first solutions, building a network of partners is a fundamental part of your GTM:

“My go-to-market strategy is literally an ecosystem partnership strategy, completely disconnecting from that point of sale until I have the product fit, and a marketing and sales engine that’s repeatable and scalable when it comes to distributors and wholesale partners.”

Jay often warns VCs off those founders that haven’t taken the steps to plot their businesses’ places in the relevant partner ecosystems:

“Most companies haven’t done the basic ‘blocking and tackling’. They don’t understand those 28 moments and the spheres of influence, they don’t have all the logos, and they don’t understand the top 100 people influencing their customers before the point of sale.

“I tell VC folks, if the founder hasn’t come to that conclusion and doesn’t know the names and faces and places in the industry, they’re not going to be a winning company no matter how good their technology is.”

The chances are that most martech solutions with any traction are already highly invested in channel sales. With both client budget and investor dollars currently in shorter supply, it would seem advisable for scaleup leaders to learn further into this approach.

How: to lead a martech during a downturn

So what leadership insights can we draw on that will be of greatest value to scaleups in the present economic climate?

Speaking from my own experience – both as an executive search professional, and as an investor – the most effective scale-up leaders need to be adaptable, collaborative, and willing to bend to feedback from their wider leadership team.

A great case in point is Vue Storefront’s Patrick Friday. Vue Storefront wasn’t Patrick’s first rodeo, and I think he’s honed his abilities as a leader across both his ventures.

Patrick and his team have shown exemplary willingness to adapt to their market-conditions, not least when they sought to break into the American market.

Agencies in North America predominantly work in React, while Vue Storefront’s library had previously been built in JavaScript. Not being wedded to his particular tool, the team pivoted to the US market by releasing a React solution in very short order, bringing them great success this side of the Atlantic.

This is a picture of a business, and of leadership, that can weather the macro-economic trends.

Then, of course, there’s the question of hiring the right people.

Mikko Kärkkäinen, the CEO and founder of RELEX Solutions has got this spot on. He’s hired a crack squad of extremely knowledgeable and experienced leaders from legacy retail solutions, and empowered people to run their departments like their own businesses; but with exemplary communication between those functions. It’s no surprise that business has gone from 500 to 1500 people in two years.

There’s also a great deal to be said for leaders who keep their profile high by making the right public statements at the right time.

Following Klaviyo’s acquisition by Shopify, Andrew Bialecki, Klaviyo’s CEO and co-founder, made this statement:

“The next era of ecommerce will be marked by a continued shift toward consumer privacy and the forming of strong digital relationships. Consumers now have an increased expectation of merchants to deliver smooth, customer-friendly experiences, and there is a continued proliferation of channels in which brands must deliver these experiences.

“This partnership builds on the combined vision of two powerful platforms to help founders and operators not just weather the new era––whatever it brings––but thrive within it.”

This comment seems almost prophetic today: highlighting one of the key factors that makes or breaks success in modern martech, including when the going gets rough.

Leadership traits of successful scaleup leaders

As an executive search professional, I’ve worked closely with martech scaleups through two major economic slumps: the dot-com crash, and the Global Financial Crisis.

From this perspective, it’s clear there are different ways that the right leadership can impact a company’s ability to scale.

Part of it comes down to the character and natural talents of the founder. The majority of leaders that succeed are collaborative, trusting, and they take time to educate the team around them.

That stands in contrast to the singularity of vision, which is popularly considered to be a defining mark of an effective leader. This is valuable in doses, but I have found that those leaders that demand rank and file, and shout orders, are often more exposed to the bumps and scrapes that the business encounters along the way.

To that end: a lot of the best leaders make a point of hiring people with different perspectives and backgrounds in order to balance their own tendencies to grab the helm. Ideally, that should include people with proven, prior experience of negotiating rocky patches in their previous roles.

Part and parcel of the CRO’s role is to help build a realistic picture of what the business can achieve, based on the available relationships and known challenges in the market. As the business scales, you can continue to deploy similarly trusted leaders in other functions that can lead from the front, managing both their departments and further hiring in a controlled and responsible manner.

Today, the smart money is not currently on another GFC-scale crash. Budget remains on the table – both from investors and customers – for companies who successfully position themselves to all stakeholders as trustworthy collaborators in growth.

Certain companies, of certain sizes, in certain solution categories, stand to perform better than others in the next couple of years, but the same is true in any economy.

By adapting to learnings from past and recent successes in the martech community, today’s scaleup leaders give their companies the greatest possible chances of success.

About The Rosenstein Group

The Rosenstein Group has been recruiting the leaders in martech sales for over 20 years. As the #1 executive search firm in martech, supply chain, ecommerce and SaaS, we specialise in recruiting heads of sales, channel sales leaders, and other members of the commercial team.

Click here to read our case studies of executive searches carried out for agencies & system integrators, or click here to learn about our work across the wider martech industry.